Unlocking Wealth with Cash Pig: Your Path to Financial Freedom

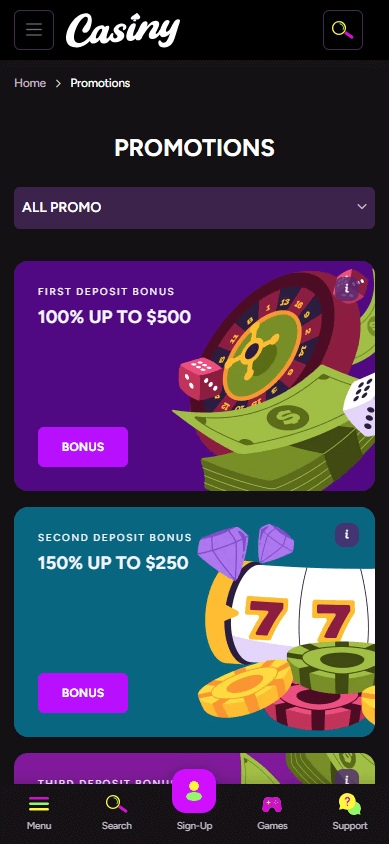

In the realm of financial opportunities, few concepts excite and intrigue as much as the «Cash Pig.» This term encapsulates the notion of a reliable and plentiful source of income that can vastly improve one’s financial situation. By understanding what a Cash Pig is and how to cultivate one, individuals can significantly enhance their earning potential. For those seeking to learn more about it and explore practical examples, feel free to check this link: Cash Pig https://casinyplay.com/cash-pig/.

What is a Cash Pig?

A Cash Pig is often referred to as a strategic asset or income-generating venture that yields consistent profits over time. This can range from investments like stocks and real estate to online business models and passive income streams. The idea is to create or identify a source of revenue that not only covers your expenses but also allows for savings and investment toward future goals.

The Concept of Financial Freedom

Achieving financial freedom is a goal for many. It’s not merely about a high income but involves proper management of resources and strategic planning. A Cash Pig is a core element in reaching this freedom; having it means you can relax while your finances work for you. Financial independence can lead to more opportunities, reduced stress, and the ability to pursue passions and dreams without the burden of financial constraints.

How to Identify Your Cash Pig

Identifying a Cash Pig is essential to building wealth. The first step is to assess your skills, interests, and resources. Are you a good writer, artist, or marketer? Identify areas where you excel and explore how to monetize them. Some common types of Cash Pigs include:

- Investments: Stocks, real estate, and mutual funds are traditional avenues for earning passive income.

- Online Ventures: Blogging, e-commerce, or affiliate marketing can yield substantial returns if managed properly.

- Rental Properties: Owning properties and renting them out can provide consistent cash flow.

- Financial Products: Developing and selling digital courses, e-books, or other information-based products can be lucrative.

Building Your Cash Pig

Once you’ve identified potential Cash Pigs, the next step is to nurture them. Here are some strategies:

- Invest Wisely: Diversify your investments to reduce risk and maximize potential returns.

- Continuous Learning: Stay informed about market trends and continue to improve your skills in your chosen ventures.

- Set Goals: Establish clear, measurable financial goals to guide your efforts and maintain motivation.

- Work on Marketing: Whether it’s through social media, email campaigns, or traditional advertising, ensure your Cash Pig is visible to potential customers or investors.

Monitoring and Scaling Your Cash Pig

After establishing your Cash Pig, it’s crucial to monitor its performance regularly. Evaluate key performance indicators (KPIs) such as ROI (Return on Investment), customer acquisition costs, and overall profitability. This data is invaluable in determining which strategies are effective and which need adjustment.

As your Cash Pig begins to generate consistent income, consider ways to scale up. Whether reinvesting profits, branching out into new markets, or even acquiring additional assets, scalability can enhance your earnings dramatically.

Common Mistakes to Avoid

While the journey to building a Cash Pig can be rewarding, it’s essential to avoid common pitfalls that can hinder progress:

- Neglecting Research: Failing to conduct thorough research before investing can lead to significant losses.

- Overextending: Spreading yourself too thin with multiple ventures can dilute focus and resources.

- Ignoring Cash Flow: Maintaining a positive cash flow is essential; always keep an eye on your expenses versus income.

- Stagnation: Don’t be afraid to innovate or pivot. Markets change, and so should your approaches.

Conclusion

Building a Cash Pig involves careful planning, consistent effort, and a willingness to learn and adapt. As you work toward financial freedom, remember that patience is key; the results take time, but the rewards can be life-changing. Embrace the journey, stay informed, and take actionable steps toward realizing your financial goals.